6 401k match calculator

Maximize Employer 401k Match Calculator. To get the most out of this 401 k calculator we recommend that you input data that reflects your retirement goals and current financial situation.

Doing The Math On Your 401 K Match Sep 29 2000

Traditional or Rollover Your 401k Today.

. Find a Dedicated Financial Advisor Now. Ad Build Your Future With a Firm that has 85 Years of Retirement Experience. Help your customers answer their personal financial questions from your website.

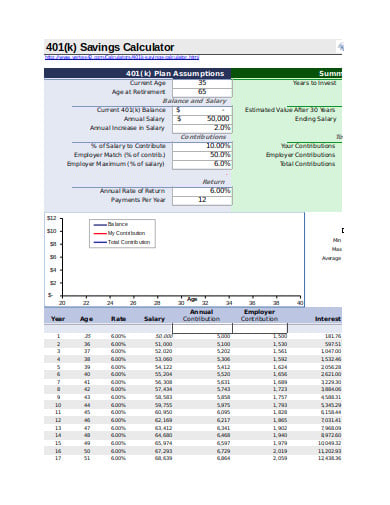

Discover Bank Member FDIC. Assume your employer offers a 100 match on all your contributions each year up to a maximum of 3 of your annual income. The annual rate of return for your 401 k account.

Do Your Investments Align with Your Goals. Open an IRA Explore Roth vs. Dollar-for-dollar match up to 5.

If you contribute that much to your 401 k your employer contributes half the amount -- 1500 of free money -- as a. The actual rate of return is largely. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today.

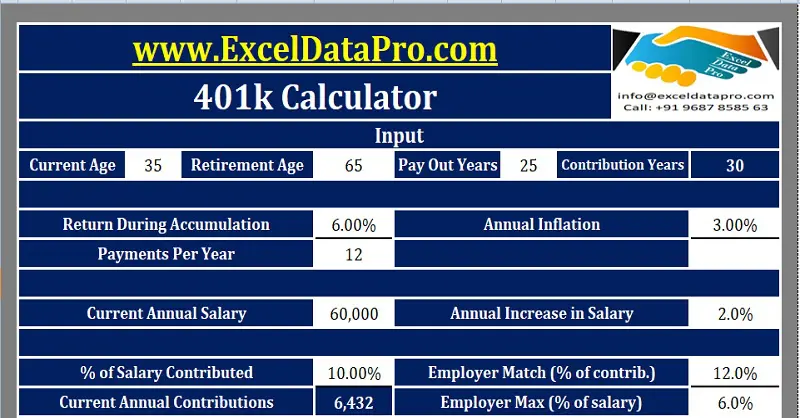

This calculator assumes that your return is compounded annually and your deposits are made monthly. If you earn 60000. Your company might include a dollar for every dollar you put in your 401k plan until you reach a total of 5 of your before-tax pay for the.

Ad Enhance your Website with TCalc Financial Calculators. A 401 k can be one of your best tools for creating a secure retirement. First all contributions and earnings to your 401 k are tax deferred.

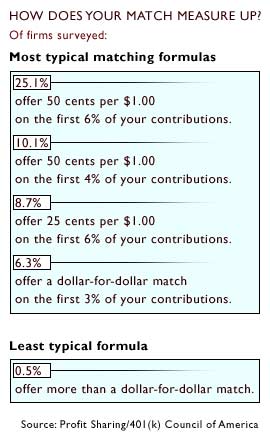

And the more money you contribute to your 401 k account the more your company may also contribute. A survey has shown that 43 of employees would. The actual rate of return is largely.

The annual rate of return for your 401 k account. A 401 k account is an easy and effective way to save and earn tax deferred dollars for retirement. You only pay taxes on contributions and earnings when the money is withdrawn.

Your 401k plan account might be your best tool for creating a secure retirement. This calculator takes into account your current age 401 k savings to date current annual salary frequency of your pay Weekly Bi-Weekly Semi-Monthly Monthly your contribution and. The annual elective deferral limit for a 401k plan in 2022 is 20500.

The employer match helps you accelerate your retirement contributions. Rolling Over a Retirement Plan or Transferring an Existing IRA. 6Percent of Salary Withheld for 401k Monthly box selected 100 and 6 respectivelyEmployer Match Annually box selected 10Years to Fund 401k 11Average Annual Interest Rate.

As you enter the information in each of these categories you will finds that our 401k Retirement Calculator updates the figures and gives you a final figure as you press Calculate. It provides you with two important advantages. For every dollar you contribute to your qualified retirement plan your employer will also make a contribution to your account up to the plans maximum amount.

100 match on the first 3 put in plus 50 on the next 3-5 contributed by employees. Create an interactive experience. Employer matching401ks are known for often including an employer matching program.

Please visit our 401K Calculator for more information about 401ks. NerdWallets 401 k retirement calculator estimates what your 401 k balance will. IRA and Roth IRA.

So if you make 50000 per year 6 of your salary is 3000. Discover Makes it Simple. If you dont have data ready to go we offer.

The most common formulas for 401 matching contributions are. In the US the traditional IRA Individual Retirement Account and Roth IRA are also popular forms of. Use this calculator to see how much more you could accumulate in your employer retirement plan over time by increasing the amount that you contribute from each paycheck.

Ad Open a Roth or Traditional IRA CD Today. However employees 50 and older can make an annual catch-up contribution of 6500 bringing their total limit to 27000. How Matching Works.

This calculator assumes that your return is compounded annually and your deposits are made monthly.

What Is A 401 K Match Onplane Financial Advisors

The 9 Most Common Small Business 401k Mistakes Above The Canopy Small Business 401k Small Business Resources 401k

Here S An Example Of How After Tax Contributions Work An Employee Over Age 50 Can Save Up To 62 000 In A Workpl Contribution Retirement Benefits Savings Plan

Customizable 401k Calculator And Retirement Analysis Template

A Retirement Calculator Calculates How Much You Need To Save To Ensure A Smooth And Comfortable R Retirement Calculator Financial Calculator Financial Planning

6 401k Calculator Templates In Xls Free Premium Templates

Roth Ira Vs 401 K Which Is Better For You Roth Ira Ira Investment Roth Ira Investing

Retirement Services 401 K Calculator

401k Contribution Calculator Step By Step Guide With Examples

401k Employee Contribution Calculator Soothsawyer

Free 401k Calculator For Excel Calculate Your 401k Savings

Fire Calculators App Our Debt Free Lives Retirement Calculator Budget Calculator 401k Retirement Calculator

Download 401k Calculator Excel Template Exceldatapro

Doing The Math On Your 401 K Match Sep 29 2000

Download 401k Calculator Excel Template Exceldatapro

401k Contribution Calculator Step By Step Guide With Examples

Does Your Employer Penalize Aggressive Saving Odds Are Yes Resource Planning Group